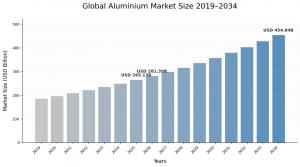

Aluminium Market to Reach USD 454.84 Billion by 2034 at 6.20% CAGR, Led by Asia Pacific

Aluminium Market Size, Industrial Demand Trends, and Industry Outlook 2026–2034

Asia Pacific dominated the aluminium market with a market share of 65.10% in 2025”

PUNE, MAHARASHTRA, INDIA, February 8, 2026 /EINPresswire.com/ -- Market Size and Growth Projection, 2026-2034— Fortune Business Insights

The global aluminium market demonstrates robust expansion, valued at USD 265.13 billion in 2025 and projected to grow to USD 281.39 billion in 2026, ultimately reaching USD 454.84 billion by 2034. This represents a compound annual growth rate of 6.20% during the forecast period. The United States market specifically is projected to reach USD 43.05 billion by 2032, driven primarily by rising adoption from electric vehicle manufacturers seeking vehicle weight reduction. Aluminium's unique combination of lightweight properties and exceptional strength has fundamentally transformed sectors ranging from aerospace to automotive, where weight reduction directly correlates with enhanced efficiency.

Request a Sample PDF: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/aluminium-market-100233

Regional Market Dynamics

Asia Pacific dominates the global market with a commanding 65.10% share in 2025, valued at USD 172.55 billion in 2025 and USD 184.32 billion in 2026. This leadership position is driven by rapid urbanization and infrastructure development, particularly in China and India. The region extensively utilizes aluminium in construction for structural components and facades. China's market alone is projected to reach USD 130.15 billion in 2026, while India is expected to attain USD 8.18 billion and Japan USD 10.84 billion during the same period. The regional automotive industry's pursuit of fuel efficiency and emission reduction significantly relies on aluminium in both conventional and electric vehicle production. Growing emphasis on metal recycling and packaging industry expansion in developing countries further contribute to regional growth momentum.

Europe represents the second-largest market, projected to reach USD 43.03 billion in 2026 with a substantial growth rate of 5.02% during the forecast period. European demand is closely linked to rapid automotive industry adoption, particularly as the region commits to reducing carbon emissions and promoting electric vehicle transition. Aluminium's lightweight properties are essential for achieving fuel efficiency and limiting carbon footprints, making it the preferred choice in automotive manufacturing. Germany's market is expected to reach USD 9.98 billion in 2026, France USD 3.12 billion in 2025, and the United Kingdom USD 1.01 billion in 2026. High demand for packaging and solar panel applications additionally drives European market growth.

North America constitutes the third-largest market, projected to hold USD 39.98 billion in 2026. The regional market is characterized by high demand from automotive and transportation industries, with electric vehicle manufacturers adopting aluminium for vehicle weight reduction. The United States market specifically is expected to reach USD 31.39 billion in 2026. North America's rapidly growing aerospace industry relies on aluminium due to its high strength-to-weight ratio, contributing to increased demand. The region's strong sustainability emphasis prompts various industries to adopt aluminium in manufacturing, packaging, and construction applications.

Product and Alloy Segmentation

Cast products accounted for the largest market share at 28.79% in 2026, expected to maintain this leading position throughout the forecast period. Products manufactured using cast aluminium demonstrate high versatility, ranging from simple handheld devices to complex automobile parts. The affordability offered by cast alloys makes them irreplaceable materials across numerous applications.

The sheet segment is estimated to experience the fastest growth during the forecast period, gaining 25% market share in 2024. Metal sheets are widely utilized in manufacturing packaging cans, automotive parts, cookware, and building products. Increasing trade activities and construction industry expansion among developing countries fuel segment growth.

Wrought alloys accounted for the largest share at 71.60% in 2026. In wrought alloy production, metal undergoes mechanical processes including forging, rolling, and extrusion, making wrought alloys mechanically stronger and more ductile compared to cast alloys. Increasing usage in applications requiring high material strength, including welding rods, aircraft frames, motorcycle frames, and pressure vessels, drives substantial segment growth with a projected rate of 6.27% during 2026-2034.

End-Use Industry Analysis

The transportation segment held the largest market share at 35.01% in 2026, driven by growing automotive industry adoption due to lightweight properties. This segment is anticipated to display a significant growth rate of 6.54% during the forecast period. In aerospace applications, aluminium proves essential due to lightweight characteristics that directly improve fuel efficiency and reduce emissions. Aircraft manufacturers including Boeing and Airbus continuously seek aircraft weight reduction to improve fuel efficiency and payload capacity. Aluminium alloys are extensively used in aircraft structures including fuselage, wings, and landing gear.

The automotive industry significantly drives product demand as global initiatives push toward carbon emission reduction and fuel economy enhancement. Rio Tinto predicts aluminium use in lightweight trucks and cars will increase approximately 30% from 177 kilograms per vehicle in 2015 to 227 kilograms per vehicle by 2025. The shift toward electric vehicles amplifies demand as aluminium helps offset heavy battery weight, enhancing electric vehicle range and efficiency.

Marine industry applications benefit from aluminium's corrosion resistance and lightweight properties, making it ideal for shipbuilding. The metal is extensively used constructing hulls and superstructures for ships, boats, and yachts. Weight reduction leads to improved fuel efficiency and increased payload capacity, crucial for commercial and military vessels.

The construction segment is expected to grow at the highest rate during the forecast period, projected to gain 20% market share in 2025. Rising construction and infrastructure development activities and increasing product adoption in interior countertops and cladding represent key growth factors.

Press For an Enquiry: https://www.fortunebusinessinsights.com/enquiry/book-a-call/aluminium-market-100233

Market Drivers and Challenges

Rising product incorporation in automotive and transportation industries represents a significant market trend. Although aluminium has been used in automobiles for many years, its proportion in new vehicles continues increasing. Electric vehicle manufacturers incorporate aluminium to reduce vehicle weight and achieve better driving range. Automotive manufacturers including Mercedes and BMW increasingly substitute stainless steel with aluminium due to similar physical properties and lightweight characteristics.

However, implementation of stricter environmental regulations may limit market growth. Several countries have adopted new regulations responding to expanding environmental concerns and increasing public expectations for government pollution reduction action. Companies producing aluminium products must invest more to comply with strict regulations, potentially restricting market growth.

Read More Research Reports:

High Strength Steel Market Size, Share & Industry Analysis

Aluminium Cylinder Market Size, Share & Industry Analysis

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

sales@fortunebusinessinsights.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.