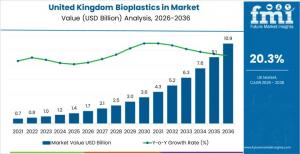

UK Bioplastics Market Projected to Reach USD 10.94 Billion by 2036 Driven by Regulatory Shifts and Packaging Innovation

The demand for bioplastics in uk is projected to grow from USD 1.7 billion in 2026 to USD 10.9 billion by 2036, at a CAGR of 20.3%.

NEWARK, DE, UNITED STATES, January 20, 2026 /EINPresswire.com/ -- The United Kingdom’s transition toward a circular economy is accelerating, with the bioplastics market projected to grow from USD 1.72 billion in 2026 to USD 10.94 billion by 2036. This expansion represents a significant 20.3% compound annual growth rate (CAGR) over the next decade, according to new industry data highlighting a systemic shift in how manufacturers, converters, and retail brands approach material sourcing.

The surge in demand is fueled by a convergence of fiscal pressures, such as the UK Plastic Packaging Tax, and a practical evolution in manufacturing capabilities. Industry leaders are increasingly moving beyond broad sustainability pledges toward measurable metrics, including reduced fossil dependency and verified end-of-life pathways.

Strategic Drivers: The Intersection of Governance and Performance

The UK has emerged as a high-intent hub for bioplastics adoption due to the rising "cost of inaction" regarding traditional plastics. Businesses operating in the UK face direct financial exposure if packaging components fail to meet the 30% recycled content threshold mandated by the Plastic Packaging Tax.

Request For Sample Report | Customize Report | Purchase Full Report -

https://www.futuremarketinsights.com/reports/sample/rep-gb-31598

Current market dynamics are defined by two critical requirements:

• Performance Compatibility: New materials must integrate seamlessly into existing filling, sealing, and forming equipment to minimize operational downtime.

• Governance Readiness: Brands are prioritizing "governance-ready" materials that offer transparent evidence for recyclability and compostability to avoid regulatory disputes and "greenwashing" allegations.

Market Segmentation: Bio-PET and Bottle Applications Lead the Transition

Data confirms that Bio-PET remains the dominant material type in the UK, currently holding a 41% market share. As a "drop-in" solution, Bio-PET allows brand owners to improve their sustainability profile without compromising the structural integrity, clarity, or barrier properties required for high-speed production lines.

In terms of application, bottles represent the largest pathway for adoption, accounting for 41.0% of total demand. This trend is particularly visible in the beverage, personal care, and household sectors, where high volume throughput makes material conversion a primary lever for meeting corporate ESG (Environmental, Social, and Governance) targets.

Regional Growth: England at the Forefront of Adoption

While adoption is rising nationwide, England is projected to lead regional growth with a 22.3% CAGR. This acceleration is attributed to the high concentration of consumer goods headquarters, major retail distribution networks, and packaging converters within the region.

Other UK regions are also showing robust growth profiles:

• Scotland (19.9% CAGR): Focusing on specialty production and high-integrity claims for food-service and consumer products.

• Wales (18.5% CAGR): Seeing increased application in agricultural and horticultural formats where biodegradable solutions offer operational advantages.

• Northern Ireland (16.3% CAGR): Advancing through targeted rollouts and supply-chain readiness.

Industry Challenges and Emerging Opportunities

Despite the bullish outlook, the sector faces structural hurdles. The efficacy of bioplastics often depends on local infrastructure for sorting and composting. To mitigate reputational risks, procurement teams are increasingly demanding EN 13432 certification and third-party verification.

However, innovation is creating new frontiers. Beyond traditional packaging, growth is emerging in medical and safety-critical packaging, where compostable medical pouches and renewable building blocks are becoming essential for highly regulated segments.

Competitive Landscape and Global Supply

Global bioplastics production capacity is expected to scale from 2.47 million tonnes in 2024 to 5.73 million tonnes by 2029. This global momentum provides UK buyers with more diversified polymer selections and improved price stability.

Leading companies shaping the UK’s bioplastic roadmap include NatureWorks LLC, BASF SE, Total Energies Corbion, Novamont S.p.A, and Mitsubishi Chemical Corporation. These participants are recognized for their ability to support converters with stable resin specifications and technical guidance during the trial-to-scale phase.

Similar Industry Reports

UK Travel Agency Services Market

https://www.futuremarketinsights.com/reports/united-kingdom-travel-agency-services-market

UK Medical Tourism Market

https://www.futuremarketinsights.com/reports/united-kingdom-medical-tourism-market

UK Processed Beef Market

https://www.futuremarketinsights.com/reports/uk-processed-beef-market

Sudip Saha

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.