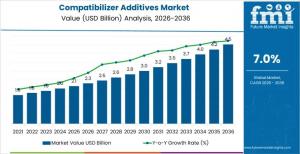

Compatibilizer Additives Market to Reach USD 4.5B by 2036 as Recycling and Multi-Polymer Blends Drive Demand

Global market grows from USD 2.3B in 2026 to USD 4.5B by 2036 at 7.0% CAGR, led by maleic-anhydride grafted polyolefins and recycled plastics demand.

NEWARK, DE, UNITED STATES, January 19, 2026 /EINPresswire.com/ -- The global compatibilizer additives market is projected to grow from USD 2.3 billion in 2026 to USD 4.5 billion by 2036, expanding at a compound annual growth rate (CAGR) of 7.00% over the forecast period. Growth is being driven by rising adoption of multi-polymer formulations, increased use of recycled plastics, and the need for consistent performance across complex polymer blends in automotive, packaging, consumer goods, and industrial applications.

Compatibilizer additives are functionalized polymers designed to improve interfacial adhesion between immiscible resins. By enabling stable blends and alloys, they address a core technical challenge in polymer processing: maintaining mechanical integrity, dispersion uniformity, and predictable rheology when combining dissimilar materials. Their role has become increasingly critical as manufacturers work with recycled resin streams and multi-material designs to meet sustainability, cost, and performance targets.

Request For Sample Report | Customize Report |purchase Full Report - https://www.futuremarketinsights.com/reports/sample/rep-gb-31533

Market Context and Growth Drivers

The expanding use of polymer blends reflects a shift toward formulation flexibility and material efficiency. In multi-polymer systems, immiscibility can result in weak interfaces, poor impact resistance, and inconsistent processing behavior. Compatibilizer additives enhance bonding between phases, supporting improved tensile strength, toughness, and long-term durability without compromising melt flow or thermal stability.

Recycled plastics utilization is a major demand catalyst. Variability in recycled polymer composition often introduces performance inconsistencies, making compatibilizers essential for maintaining quality and processing reliability. At the same time, lightweighting initiatives in automotive and transportation, along with sustainability goals in packaging, are reinforcing the need for high-performance polymer alloys that depend on effective compatibilization.

Competitive power in the market is concentrated among a small group of global polymer and additive producers with deep chemistry portfolios and close integration into resin supply chains. These companies defend pricing power through proprietary grafting technologies, application-specific formulations, and long-standing qualification with compounders and original equipment manufacturers (OEMs). High entry barriers persist due to the technical complexity of reactive compatibilizer design, the need for extensive validation across polymer systems, and the capital intensity of scaling production with consistent molecular control.

Chemistry and Application Structure

• By chemistry, maleic-anhydride grafted polyolefins represent the leading segment, accounting for 46% of global market share. These materials are widely used to improve compatibility between non-polar polyolefins and polar polymers such as polyamides and engineering plastics. Their predictable reaction behavior, processing stability, and broad applicability across resin combinations make them the preferred choice for compounders seeking reliable performance enhancement.

• Other chemistries include glycidyl and other reactive compatibilizers, along with styrenic and polar compatibilizers used in specialty and engineering polymer systems. These alternatives address specific interfacial challenges where targeted reactivity or polarity control is required.

• By application, polyolefin blends and alloys dominate with a 34% share of global demand. Blending allows manufacturers to tailor material properties without developing new polymers, but immiscibility issues require effective compatibilization to achieve acceptable mechanical performance. High production volumes of polyolefin blends in automotive components, consumer goods, and industrial products sustain consistent demand for compatibilizer additives. Additional application segments include recycled plastics and mixed polymer streams, engineering plastics and blends, and other uses where phase stability and mechanical integrity are essential.

Regional and Country-Level Growth Trends

The market is expanding across all major regions, including Asia Pacific, Europe, North America, Latin America, and the Middle East & Africa. Growth rates vary by country based on polymer compounding activity, recycled plastics adoption, and demand for multi-material formulations.

China leads with a forecast CAGR of 8.2% from 2026 to 2036, driven by large-scale polymer processing, extensive use of recycled plastics, and strong demand from packaging, consumer goods, and automotive sectors. Brazil follows at 7.8% CAGR, supported by rising recycled polymer utilization and expansion of plastics compounding. The United Kingdom (6.7%) and Germany (6.6%) show steady growth anchored in high-quality recycled content formulations, automotive plastics, and advanced engineering compounds. South Korea’s market, growing at 6.2%, benefits from demand in electronics housings, automotive components, and export-oriented consumer products.

High-growth markets emphasize cost efficiency and scalability, while mature regions prioritize formulation precision, reproducible performance, and regulatory compliance. Across all regions, buyer preference is increasingly shifting toward proven suppliers with established technical support capabilities.

Competitive Landscape

Key players in the compatibilizer additives market include Dow, ExxonMobil Chemical, LyondellBasell, Mitsui Chemicals, SABIC, Arkema, BASF, Borealis, SK Functional Polymer, and INEOS Olefins & Polymers. These companies compete on chemistry depth, performance reliability across mixed polymer systems, and the ability to improve interfacial adhesion without compromising processing efficiency.

Dow and ExxonMobil Chemical leverage backward integration and polymer science expertise to supply compatibilizers optimized for polyolefin blends and recycled plastics. LyondellBasell and SABIC position compatibilizers as part of integrated material solutions for automotive, packaging, and infrastructure. Mitsui Chemicals and BASF focus on reactive and specialty chemistries for high-value engineering plastics, while Arkema and Borealis emphasize recyclability and lightweighting. Regional suppliers add competitive pressure through focused portfolios and localized technical support.

Outlook

The compatibilizer additives market is expected to maintain steady growth as recycled-content mandates and multi-polymer formulations become standard across industries. Buyer preference is shifting toward suppliers with proven interfacial performance, formulation flexibility, and alignment with circular economy goals. As a result, compatibilizers are increasingly viewed not as optional additives, but as critical enablers of advanced polymer blending and sustainable materials strategies.

Browse Related Insights

Germany Green and Bio-based Polyol Market: https://www.futuremarketinsights.com/reports/germany-green-and-bio-based-polyol-market

Japan Green and Bio-based Polyol Market: https://www.futuremarketinsights.com/reports/japan-green-and-bio-based-polyol-market

United Kingdom Green and Bio-based Polyol Market: https://www.futuremarketinsights.com/reports/united-kingdom-green-and-bio-based-polyol-market

United States Green

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.

Sudip Saha

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.