Generative Artificial Intelligence (AI) In Banking And Finance Market In 2029

The Business Research Company's Generative Artificial Intelligence (AI) In Banking And Finance Market 2025 – Market Size, Trends, And Global Forecast 2025-2034

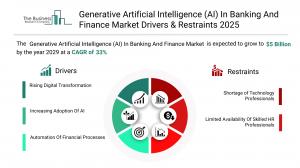

LONDON, GREATER LONDON, UNITED KINGDOM, December 24, 2025 /EINPresswire.com/ -- "Generative Artificial Intelligence (AI) In Banking And Finance Market to Surpass $5 billion in 2029. Within the broader Financial Services industry, which is expected to be $47,553 billion by 2029, the Generative Artificial Intelligence (AI) In Banking And Finance market is estimated to account for nearly 0.1% of the total market value.

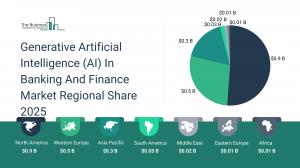

Which Will Be the Biggest Region in the Generative Artificial Intelligence (AI) In Banking And Finance Market in 2029

North America will be the largest region in the generative artificial intelligence (AI) in banking and finance market in 2029, valued at $2,504 million. The market is expected to grow from $676 million in 2024 at a compound annual growth rate (CAGR) of 30%. The exponential growth is supported by the increasing utilization of generative AI in fraud detection and rising artificial intelligence (AI) adoption.

Which Will Be The Largest Country In The Global Generative Artificial Intelligence (AI) In Banking And Finance Market In 2029?

The USA will be the largest country in the generative artificial intelligence (AI) in banking and finance market in 2029, valued at $2,265 million. The market is expected to grow from $611 million in 2024 at a compound annual growth rate (CAGR) of 30%. The exponential growth can be attributed to the increasing focus on data security and integration with artificial intelligence (AI).

Request a free sample of the Generative Artificial Intelligence (AI) In Banking And Finance Market report

https://www.thebusinessresearchcompany.com/sample_request?id=19467&type=smp

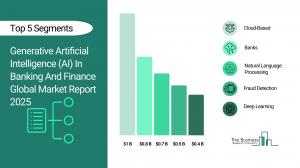

What will be Largest Segment in the Generative Artificial Intelligence (AI) In Banking And Finance Market in 2029?

The generative artificial intelligence (AI) in banking and finance market is segmented by technology into natural language processing (NLP), deep learning, reinforcement learning, generative adversarial networks, computer vision and predictive analytics. The natural language processing market will be the largest segment of the generative artificial intelligence (AI) in banking and finance market segmented by technology, accounting for 50% or $2,503 million of the total in 2029. The natural language processing market will be supported by the increasing adoption of AI-powered chatbots and virtual assistants.

The generative artificial intelligence (AI) in banking and finance market is segmented by deployment model into on-premises and cloud-based. The cloud-based market will be the largest segment of the generative artificial intelligence (AI) in banking and finance market segmented by deployment model, accounting for 95% or $4,733 million of the total in 2029. The cloud-based market will be supported by embrace digital transformation, the adoption of cloud-based generative AI solutions is expected to accelerate.

The generative artificial intelligence (AI) in banking and finance market is segmented by application into fraud detection, customer service, risk assessment, compliance, trading and portfolio management and other applications. The fraud detection market will be the largest segment of the generative artificial intelligence (AI) in banking and finance market segmented by application, accounting for 28% or $1,405 million of the total in 2029. The fraud detection market will be supported by ongoing research and development, increasing utilization of generative AI in fraud detection and coupled with advancements in computational capabilities.

The generative artificial intelligence (AI) in banking and finance market is segmented by end user into banks, insurance company, investment firm, fintech company and other end users. The banks market will be the largest segment of the generative artificial intelligence (AI) in banking and finance market segmented by end user, accounting for 55% or $2,765 million of the total in 2029. The banks market will be supported by enhanced operational efficiency, customer engagement and risk management. Banks play a crucial role in the generative AI market by integrating AI-driven solutions to enhance customer experiences, streamline operations and improve risk management. They leverage generative AI for personalized financial services, fraud detection and automated compliance, driving efficiency and innovation in the industry.

What is the expected CAGR for the Generative Artificial Intelligence (AI) In Banking And Finance Market leading up to 2029?

The expected CAGR for the generative artificial intelligence (AI) in banking and finance market leading up to 2029 is 33%.

What Will Be The Growth Driving Factors In The Generative Artificial Intelligence (AI) In Banking And Finance Market In The Forecast Period?The rapid growth of the global generative artificial intelligence (AI) in banking and finance market leading up to 2029 will be driven by the following key factors that are expected to reshape customer experience, risk management, operational efficiency, and business models across the financial services industry worldwide.

Strong Economic Growth - The strong economic growth will become a key driver of growth in the generative artificial intelligence (AI) in banking and finance market by 2029. During periods of economic growth, banks and financial institutions benefit from higher profits and increased capital availability. This financial surplus allows them to invest in advanced technologies such as generative AI to enhance services, streamline operations, and strengthen their competitive position. A thriving economy also drives innovation and intensifies competition, prompting institutions to leverage AI for developing new financial products, optimizing robo-advisory services, and deploying intelligent chatbots to improve customer experience and retention. As a result, the strong economic growth is anticipated to contributing to annual growth in the market.

Rapid Urbanization - The rapid urbanization will emerge as a major factor driving the expansion of the generative artificial intelligence (AI) in banking and finance market by 2029. Urbanization accelerates the adoption of digital banking as city dwellers increasingly rely on online and mobile financial services. The surge in digital transactions generates extensive financial data, enabling generative AI to enhance fraud detection, deepen customer insights, and deliver personalized financial solutions. Consequently, the rapid urbanization is projected to contributing to annual growth in the market.

Increasing Digital Transformation - The increasing digital transformation within digital manufacturing processes will serve as a key growth catalyst for the generative artificial intelligence (AI) in banking and finance market by 2029. Digital transformation is accelerating the adoption of AI-driven solutions in banking, streamlining tasks such as loan approvals, fraud detection, and risk assessment. Generative AI enhances efficiency by producing reports, summaries, and customer insights, while automation minimizes manual processing, significantly reducing operational costs. By optimizing workflows, AI shortens approval times for loans and credit assessments, improving overall banking efficiency. Therefore, this increasing digital transformation is projected to supporting to annual growth in the market.

Increasing Adoption Of AI - The increasing adoption of AI will become a significant driver contributing to the growth of the generative artificial intelligence (AI) in banking and finance market by 2029. Generative AI enhances customer satisfaction by analyzing data to deliver personalized financial insights. AI-powered chatbots and virtual assistants provide 24/7 support, improving response times and reducing operational expenses. Automated document processing streamlines administrative tasks by generating compliant reports, summaries, and financial statements with minimal human intervention. Additionally, AI-driven real-time monitoring ensures regulatory compliance by detecting and preventing violations in transactions. Consequently, the increasing adoption of AI is projected to contributing to annual growth in the market.

Automation of Banking Operations - The automation of banking operations will become a significant driver contributing to the growth of the generative artificial intelligence (AI) in banking and finance market by 2029. Banks handle extensive documentation, including loan applications, financial statements, and contracts. Generative AI streamlines operations by extracting key data, summarizing content, and generating reports, minimizing manual effort and errors. Consequently, the automation of banking operations is projected to contributing to annual growth in the market.

Favorable Government Support - The favorable government support will become a significant driver contributing to the growth of the generative artificial intelligence (AI) in banking and finance market by 2029. Governments worldwide are actively fostering AI innovation in the banking and fintech sectors through targeted investments, including grants, subsidies, and R&D tax incentives. Public-private collaborations are accelerating the adoption of generative AI for fraud detection, personalized financial services, and automated customer support. Central banks are also leveraging AI-powered financial regulation to enhance market surveillance and mitigate systemic risks in real time. Consequently, the favorable government support is projected to contributing to annual growth in the market.

Access the detailed Generative Artificial Intelligence (AI) In Banking And Finance Market report here:

https://www.thebusinessresearchcompany.com/report/generative-artificial-intelligence-ai-in-banking-and-finance-market

What Are The Key Growth Opportunities In The Generative Artificial Intelligence (AI) In Banking And Finance Market in 2029?

The most significant growth opportunities are anticipated in the cloud-based generative artificial intelligence (AI) in banking and finance market, the generative artificial intelligence (AI) in banks market, the NLP-driven generative artificial intelligence (AI) in banking and finance market, and the generative artificial intelligence (AI) in banking and finance for fraud detection market. Collectively, these segments are projected to contribute over $9 billion in market value by 2029, driven by advances in real-time automation, enhanced accuracy in risk assessment and fraud detection, and expanding applications across customer experience, compliance, and financial operations. This surge reflects the accelerating adoption of AI technologies that enable predictive insights, operational efficiency, and personalized financial services, fueling transformative growth within the broader generative AI in banking and finance industry.

The cloud-based generative artificial intelligence (AI) in banking and finance market is projected to grow by $3,795 million, the generative artificial intelligence (AI) in banks market by $2,138 million, the NLP-driven generative artificial intelligence (AI) in banking and finance market by $2,024 million, and the generative artificial intelligence (AI) in banking and finance for fraud detection market by $993 million over the next five years from 2024 to 2029.

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. We have published over 17,500 reports across 27 industries and 60+ geographies. Our research is powered by 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders.

We provide continuous and custom research services, offering a range of specialized packages tailored to your needs, including Market Entry Research Package, Competitor Tracking Package, Supplier & Distributor Package and much more

Disclaimer: Please note that the findings, conclusions and recommendations that TBRC Business Research Pvt Ltd delivers are based on information gathered in good faith from both primary and secondary sources, whose accuracy we are not always in a position to guarantee. As such TBRC Business Research Pvt Ltd can accept no liability whatever for actions taken based on any information that may subsequently prove to be incorrect. Analysis and findings included in TBRC reports and presentations are our estimates, opinions and are not intended as statements of fact or investment guidance.

The Business Research Company

Americas +1 310-496-7795

Europe +44 7882 955267

Asia & Others +44 7882 955267 & +91 8897263534

Email: info@tbrc.info"

Oliver Guirdham

The Business Research Company

+44 7882 955267

info@tbrc.info

Visit us on social media:

LinkedIn

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.