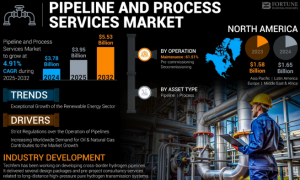

The Global Pipeline and Process Services Market Grow to USD 5.53 Billion by 2032 with a CAGR of 4.91% during 2032

List of Top key Players in Pipeline and Process Services are Halliburton, BlueFin Services (Gate Energy), Altus Intervention, Techfem, Eunisell Limited

North America dominated the global market with a share of 47.28% in 2024.”

PUNE, MAHARASHTRA, INDIA, September 25, 2025 /EINPresswire.com/ -- The global pipeline and process services market size was valued at USD 3.78 billion in 2024. The market is projected to grow from USD 3.95 billion in 2024 to USD 5.53 billion by 2032, exhibiting a CAGR of 4.91% during the forecast period. — Fortune Business Insights

Request a Sample Research PDF: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/pipeline-and-process-services-market-105466

Market Size and Growth Projections

Fortune Business Insights estimates the market at USD 3.95 billion in 2024 and projects growth to USD 5.53 billion by 2032, at a CAGR of 4.91% during the forecast period. Regional leadership in 2024 was with North America (largest share). The U.S. pipeline & process services market shows particularly strong activity driven by midstream investments and maintenance programs.

Key Drivers of Market Growth

Infrastructure Rehabilitation: Aging pipeline infrastructure requires regular maintenance and upgrades to ensure safety and efficiency.

Globalization of Energy Trade: Increasing international energy trade necessitates the construction and maintenance of extensive pipeline networks.

Shifts in Energy Sources: Transitioning to cleaner energy sources demands modifications in existing pipeline systems to accommodate new types of fuels.

Economic Factors: Economic growth leads to higher energy demand, driving the need for expanded pipeline and process services.

Infrastructure Expansion: Growing urbanization and industrialization require the development of new pipeline networks and processing facilities.

• Aging pipeline infrastructure requiring frequent inspection, cleaning, integrity testing, and maintenance.

• Stringent regulatory standards (safety, environment) globally that force regular checks, safety compliance, pressure testing etc.

• Growth in oil & gas transmission demand, new pipeline installations and expansion (especially gas pipelines) to support energy demand and possibly shifting from other fuels.

• Technology adoption: Digitalization, IoT, real-time monitoring, predictive analytics to improve safety, reduce downtime, optimize operations.

The COVID-19 pandemic had a notable impact on the market. Lockdowns and travel restrictions led to project delays, workforce shortages, and supply chain disruptions, affecting the timely delivery of services and equipment. Despite these challenges, the market rebounded as operators prioritized essential maintenance and commissioning projects to ensure uninterrupted energy supply and compliance with safety regulations.

Future Outlook

The pipeline and process services market is expected to witness steady growth through 2032, with North America maintaining the largest share due to its extensive pipeline network and Asia Pacific emerging as the fastest-growing region. Increasing investment in pre-commissioning, maintenance, and decommissioning activities, along with technological innovations, will drive future market expansion.

Report Coverage

This report provides an in-depth analysis of the pipeline and process services market, covering key aspects such as:

• Market Size & Forecast: Current market size, historical trends and future projections.

• Key Market Drivers & Restraints: Opportunities, challenges and regulatory impacts.

• Segmentation & Regional Analysis: Breakdown by service type, end-use industry, and geography.

• Competitive Landscape: Profiles of major service providers, mergers, partnerships and recent developments.

• Technological Advancements: Innovations in inspection, NDT, robotics, and digital monitoring.

• Project Pipeline: Major ongoing and upcoming midstream and processing projects influencing demand.

Segmentation Analysis

Service Type: Inspection & Integrity, Pre-commissioning & Commissioning, Construction & Installation, Rehabilitation & Maintenance, Decommissioning.

End-User Industry: Oil & Gas (midstream & upstream pipelines), Petrochemicals & Refining, Power & Utilities, Water & Wastewater, Industrial Processing.

Geography: North America (largest share in 2024), Europe, Asia Pacific, Latin America, Middle East & Africa.

Market segmentation reveals that pipeline and process services are offered across multiple stages of asset management. Pre-commissioning services involve preparing pipelines and facilities for operational readiness, ensuring they meet safety and performance standards. Maintenance services cover ongoing inspections, preventive maintenance, repairs, and monitoring to maximize uptime and reliability. Decommissioning services handle the safe removal or repurposing of obsolete or redundant assets. This full spectrum of services ensures operators can manage pipelines and process facilities throughout their lifecycle, from construction to end-of-life management.

Request a Sample Research PDF: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/pipeline-and-process-services-market-105466

A major factor contributing to market growth is the rehabilitation of aging pipeline infrastructure. Many countries are faced with the challenge of maintaining pipelines and processing facilities that have been in service for decades. Aging pipelines pose operational and safety risks, requiring services such as inspection, cleaning, maintenance, and repair. Utilities and industrial operators are increasingly investing in preventive and corrective services to extend the lifespan of their assets and reduce the risk of costly downtime or environmental incidents. This trend is particularly strong in North America, where stringent regulatory frameworks mandate regular maintenance and integrity management for pipelines and process facilities.

The globalization of energy trade is another key driver. Increasing international demand for oil, gas, and other energy products has led to the construction of new pipelines, storage, and processing facilities in key markets. Pipeline and process service providers are engaged in activities ranging from pre-commissioning services—such as hydrotesting, cleaning, and inspection—to ongoing maintenance operations that ensure pipelines function safely and efficiently. Moreover, decommissioning services are gaining attention as older pipelines and processing facilities are retired or replaced, creating new opportunities for service providers to manage safe dismantling, waste handling, and repurposing.

LIST OF KEY COMPANIES PROFILED IN THE REPORT:

Baker Hughes: A leading provider of pipeline and process services, offering a range of solutions from pre-commissioning to decommissioning.

Halliburton: Provides comprehensive services for pipeline construction, maintenance, and integrity management.

Schneider Electric: Offers automation and digitalization solutions for pipeline and process operations.

GE: Supplies equipment and services for pipeline construction and maintenance.

Enbridge: Operates extensive pipeline networks and provides related services.

Major players in the pipeline and process services market focus on broad service portfolios, global footprints and technology-driven offerings. Some key players include:

• Halliburton (U.S.)

• BlueFin Services (Gate Energy) (U.S.)

• Altus Intervention (Norway)

• Techfem (Italy)

• Eunisell Limited (Nigeria)

• EnerMech (U.S.)

• Chenergy Services Limited (Nigeria)

• CR3 (Thailand)

• Alphaden Energy & Oilfield Limited (U.S.)

• Trans Asia Group (UAE)

• T.D. Williamson, Inc (U.S.)

• STATS Group (United Kingdom)

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

sales@fortunebusinessinsights.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.